House prices in northeast Victoria and southern New South Wales

What changes do we see in property prices and housing affordability in our region?

Tuesday, May 28, 2024

/

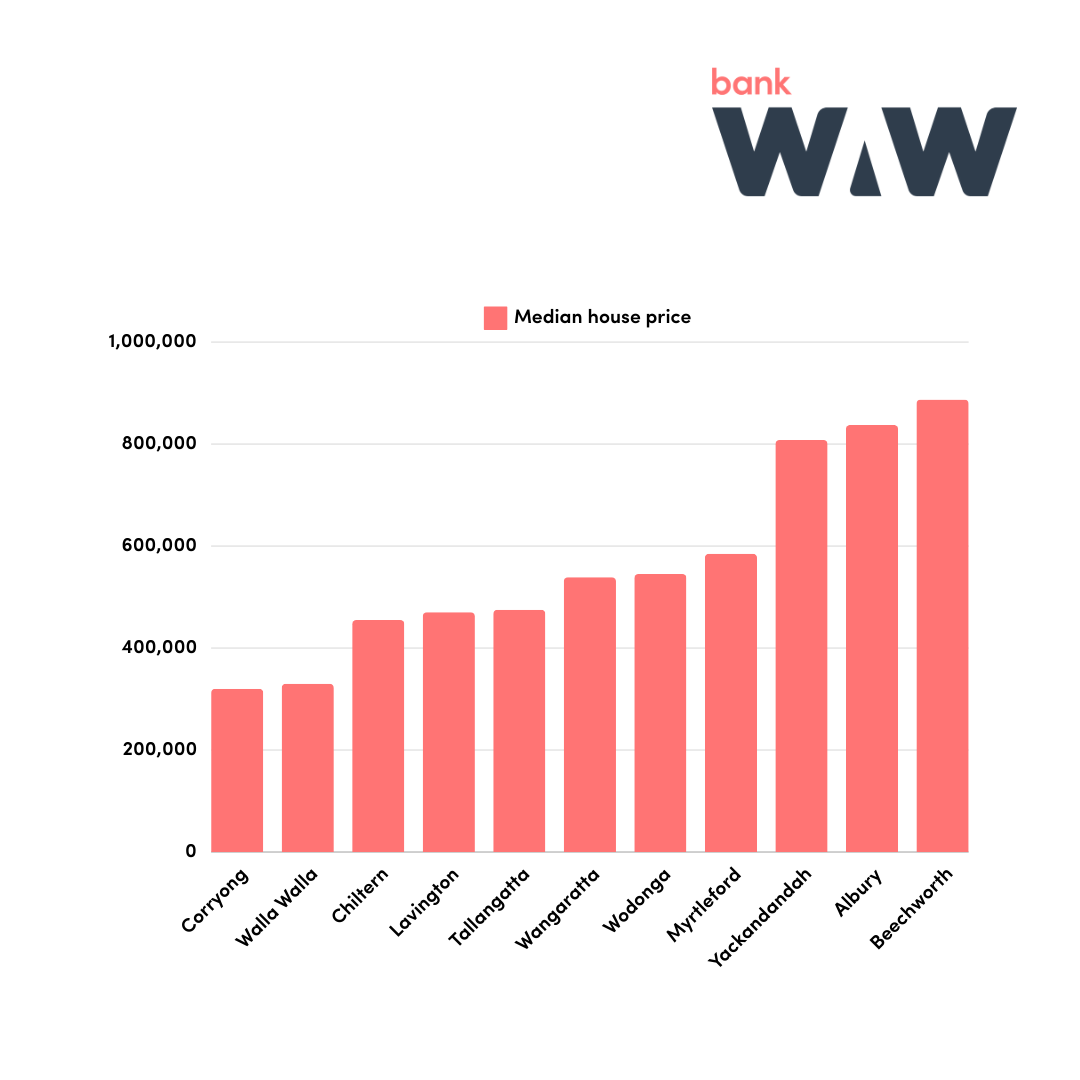

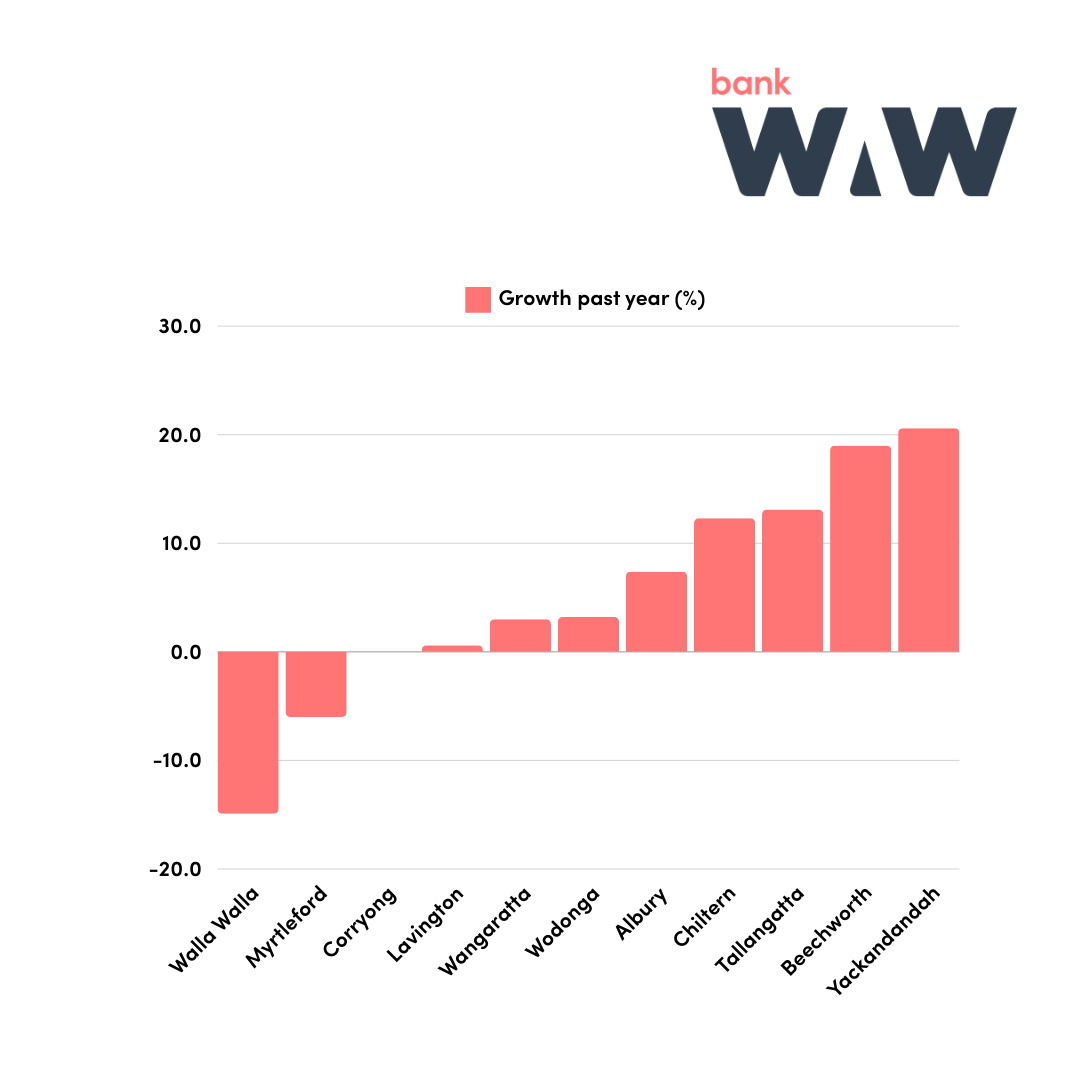

1. Median house prices are going up, but not everywhere

The median house prices over the past 12 months in our region show that Corryong and Walla Walla are the two towns where houses are cheapest in the low 300k's, compared to the most expensive markets of Yackandandah, Albury and Beechworth where the median house price is over $800k. Over the past year, house prices in Yack, Beechworth,Tallangatta and Chiltern went up by more than 12%, with Yackandandah leading the pack with a 20.6% increase for houses sold, as the next graph shows. Walla Walla and Myrtleford are the only two towns where median house prices went down.

Data of median house prices is taken from realestate.com.au. Median is the value of the house exactly in the middle of all the houses sold in the past 12 months.

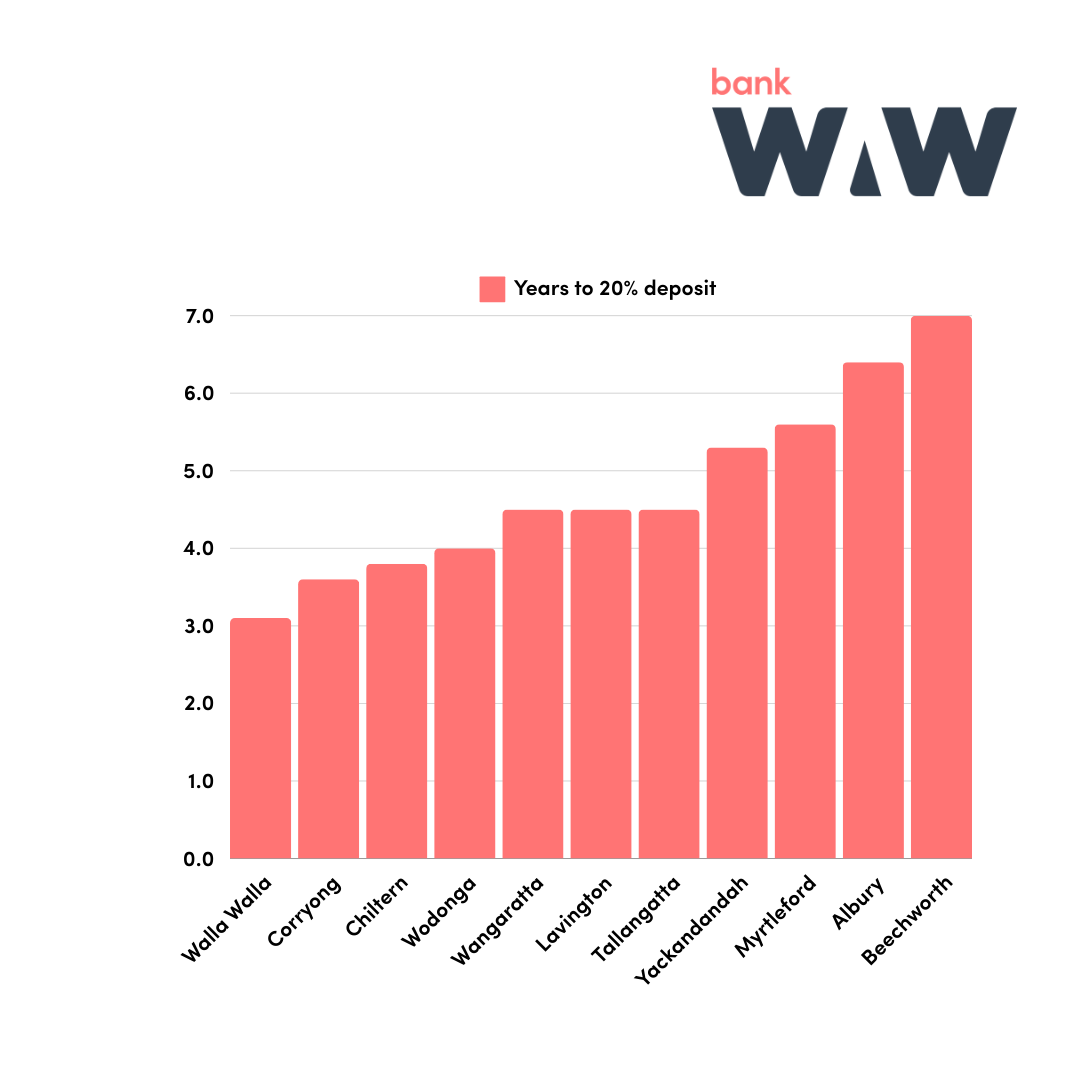

2. Where can you afford to buy?

How long would it take to pay for a home in one of our beautiful towns? It can take between 17 years for a home in Corryong and 40 years for a property in Beechworth to save up enough money to buy a house outright, right now. If you want to take out a mortgage and have the 20% deposit outright, our repayment calculator shows that your weekly repayment will be minimally $366 for a median house in Corryong and maximally $1,013 for a house in Beechworth. Below graph is based on the median income in each town, and the assumption that 30% of that income is saved to pay for a house.

If you are a home buyer looking to make a 20% deposit and you save 35% of your income, it will take between 3 and 7 years to save up for the deposit alone. If you are a first time home buyer, you can speed that up by using the Home Guarantee Scheme which reduces the deposit to only 5%.

Data of median house prices is taken from realestate.com.au. Data on median incomes is for 2021 from the Australian Bureau of Statistics.

3. Our regional housing market

House prices and interest rates are high, and the cost of living has gone up. A family home in the more expensive towns of our region seems out of reach for anyone but high-earners or people who sell a property somewhere else. Of course, there are opportunities in the cheaper towns and for smaller homes in the more expensive towns, and the First Home Buyer Grant may help out first-time buyers. Your budget for housing decides a lot - and if you want to talk to one of our friendly lenders to see what your mortgage options are, we are always happy to help!